How can business activity monitoring and controlling help you to get funded fairly in 2024?

15.02.2023

According to management studies, business activity monitoring and controlling significantly increase a startup’s chances of obtaining fair financing. But how does this process work, and what specific steps can you take to implement an effective system?

The Power of Business Activity Monitoring and Controlling

A robust business activity monitoring and controlling system allows you to retrieve and analyze business information over time. This preparedness is crucial for successful negotiations with investors. Here’s how it works:

1. Demonstrating Market Understanding

- Thorough Understanding:

- Investors seek assurance that you deeply understand your market and industry. Regular monitoring provides insights into market trends, customer behaviors, and competitive landscape, showcasing your expertise.

- Market Insights:

- By analyzing KPIs and market data, you can present solid evidence of your market knowledge, making your startup more attractive to investors.

2. Justifying and Validating Your Business Plan

- Data-Driven Plans:

- A well-monitored business can produce data-driven business plans and financial forecasts. Investors appreciate startups that base their projections on actual data rather than assumptions.

- Validation:

- Detailed monitoring helps you validate your business plan by showing how past performance aligns with future projections, increasing investor confidence in your forecasts.

Steps to Implement an Effective Monitoring and Controlling System

1. Identify Industry-Specific KPIs

- Select Relevant KPIs:

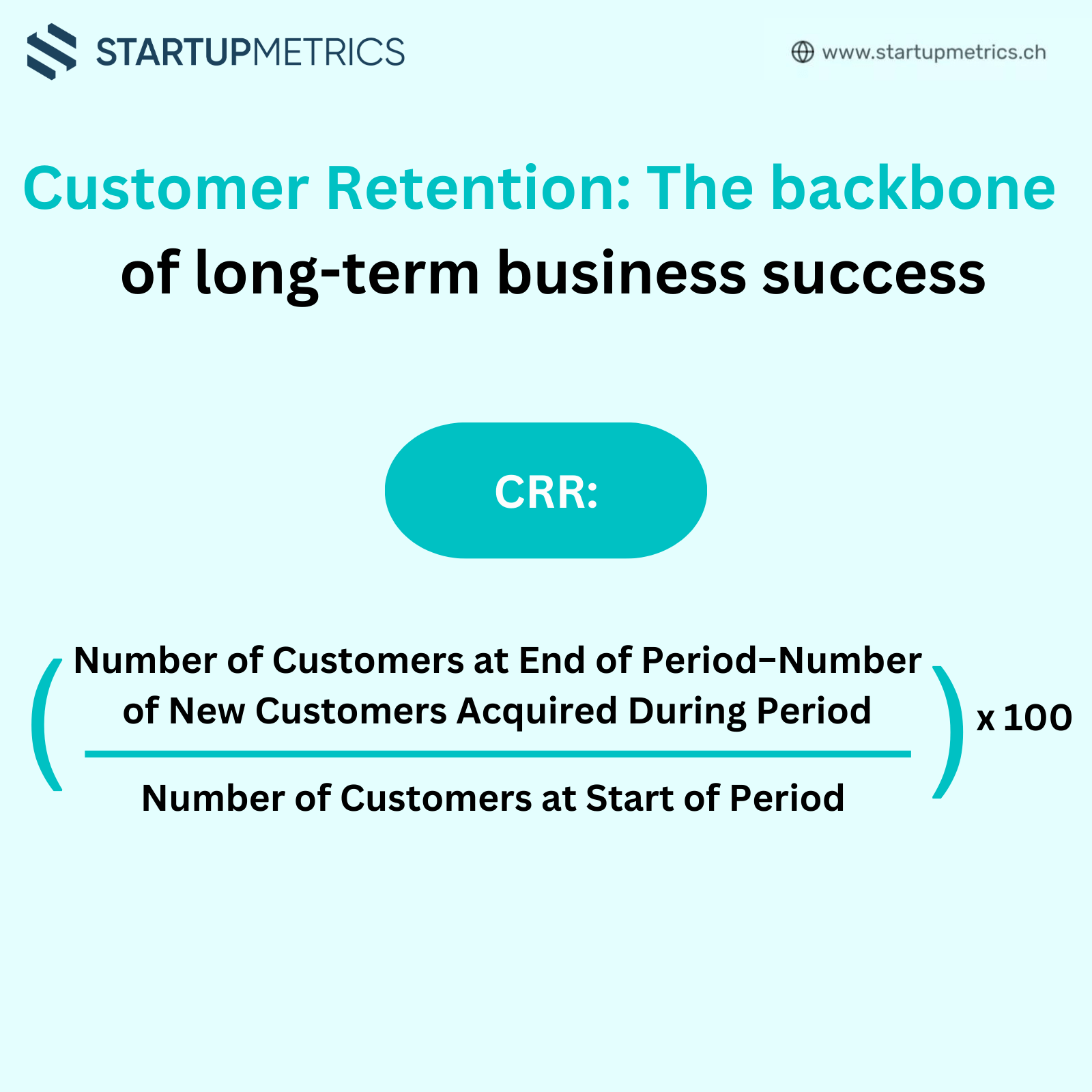

- Identify key performance indicators (KPIs) specific to your industry that are crucial for measuring success. Examples include Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), Customer Lifetime Value (CLV), and churn rate.

- Align with Goals:

- Ensure these KPIs align with your strategic objectives and provide meaningful insights into your business operations.

2. Track and Monitor KPIs Periodically

- Regular Monitoring:

- Set up a schedule for regular tracking and monitoring of your KPIs. This could be daily, weekly, or monthly, depending on the nature of your business and the specific KPIs.

- Use Technology:

- Leverage business intelligence tools, CRM systems, and financial software to automate data collection and analysis, ensuring accuracy and efficiency.

3. Relate KPIs to Industry Benchmarks

- Benchmark Comparison:

- Compare your KPIs against industry benchmarks to assess your performance relative to competitors. This helps identify areas of strength and opportunities for improvement.

- Competitive Analysis:

- Use this comparison to conduct a competitive analysis, positioning your startup favorably in investor presentations.

4. Use Retrieved Information to Create Validated Plans

- Data-Driven Business Plan:

- Utilize the data from your monitoring system to create a business plan that is realistic, achievable, and backed by solid evidence.

- Financial Forecasts:

- Develop financial forecasts based on historical data and market trends. This validation increases credibility and reduces perceived risk for investors.

The Impact of a Monitoring System on Funding Negotiations

A well-implemented business activity monitoring and controlling system prepares you optimally for negotiations with investors. Here’s how:

1. Enhanced Credibility

- Evidence-Based Discussions:

- Presenting data-driven insights and validated forecasts enhances your credibility. Investors are more likely to trust and invest in startups that demonstrate transparency and reliability.

- Risk Mitigation:

- By showcasing thorough market understanding and validated plans, you mitigate perceived risks, making your startup a safer bet for investors.

2. Stronger Negotiation Position

- Clear Justifications:

- Clear, data-backed justifications for your valuation and funding needs strengthen your negotiation position. You can confidently explain and defend your business’s worth.

- Negotiation Leverage:

- Well-documented performance and growth potential provide leverage, allowing you to negotiate better terms and secure fair financing.

Case Study: Slack’s Data-Driven Approach to Funding

Slack, the widely-used collaboration tool, is a prime example of how effective business activity monitoring and controlling can aid in securing fair funding.

1. Identifying KPIs

Slack identified key metrics such as daily active users, user engagement levels, and customer retention rates. These KPIs were crucial in understanding their growth trajectory and user satisfaction.

2. Regular Monitoring

They tracked these KPIs meticulously, using advanced analytics tools to gather real-time data. This allowed them to monitor trends and make data-driven decisions quickly.

3. Benchmarking Against Competitors

Slack compared their performance metrics with industry standards and competitors, showcasing their superior user engagement and rapid growth rates to potential investors.

4. Data-Driven Business Plan

Using the collected data, Slack created a compelling business plan and financial forecast, demonstrating their potential for sustained growth and profitability.

Conclusion

Business activity monitoring and controlling provide the foresight needed to lead your startup effectively and secure fair funding. By identifying and tracking relevant KPIs, benchmarking performance, and using data to create validated business plans, you can present a convincing case to investors.

A well-monitored business not only demonstrates deep market understanding but also validates its projections, reducing investor risk and increasing the likelihood of securing the necessary funds. Implementing a robust monitoring system is a strategic move that positions your startup for success in investor negotiations.

If you need assistance in setting up an effective business activity monitoring and controlling system, contact us. We offer tailored solutions to help you navigate the funding landscape with confidence and achieve your business goals.