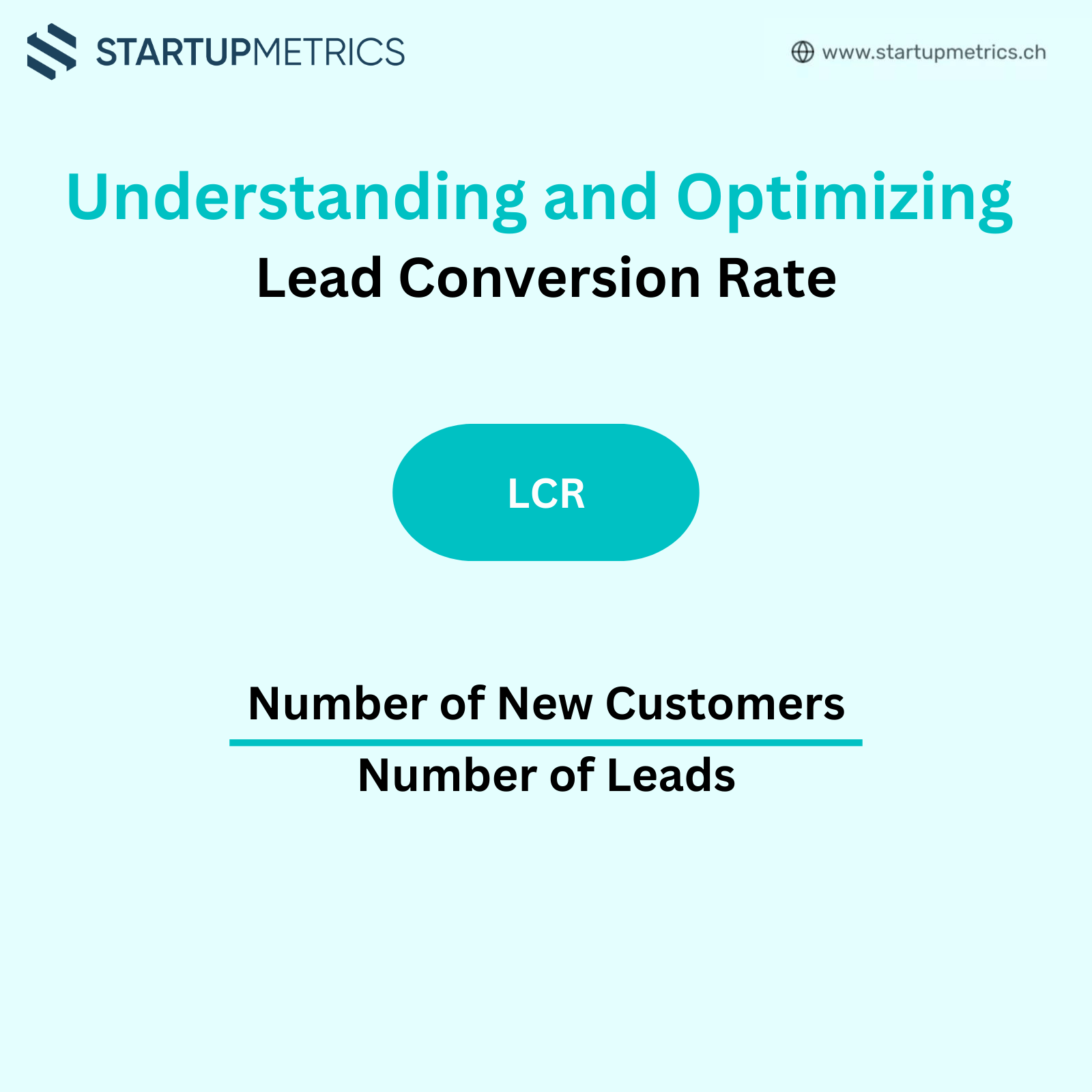

Understanding and Optimizing Lead Conversion Rate

The lead conversion rate is a valuable metric that tells you how many potential customers you need to connect with…

Understanding and leveraging the core elements of financial management is critical for organizations to not only survive but thrive. When implemented carefully, these pillars promote effective financial governance, enabling businesses to navigate the complexities of financial planning, execution, and strategy with precision and foresight. They include:

Often considered the language of business, accounting provides a systematic and comprehensive recording of financial transactions. This pillar forms the foundation of financial management, ensuring accuracy in financial reporting and compliance with regulatory standards.

Key Functions:

This pillar emphasizes the importance of oversight in financial management. Through performance management and governance, businesses can ensure that their financial operations align with strategic objectives, identifying variances and implementing corrective actions promptly. It’s about controlling financial resources and ensuring they are used efficiently and effectively.

Key Functions:

At the heart of financial planning and analysis, budgeting and forecasting enable businesses to prepare and plan for the future. By projecting income, expenses, and capital needs, companies can make informed decisions that align with their long-term goals. This pillar is crucial for steering the company, managing financial resources proactively, ultimately allowing businesses to anticipate changes and adapt strategies accordingly.

Key Functions:

The final pillar, strategic financial management, integrates financial expertise through communication with other business areas to promote a unified strategy for achieving organizational objectives. It’s about leveraging financial insights to guide overall strategic planning and decision-making.

Key Functions:

While bookkeeping is essential for recording daily transactions, it is only one aspect of comprehensive financial management. Relying solely on bookkeeping can leave significant gaps in an organization’s financial oversight and strategic planning. Here’s why:

While most classical accounting firms only offer bookkeeping services, we at Startupmetrics provide a holistic solution, addressing a client’s unique financial needs. Our approach encompasses all four pillars of financial management, ensuring robust financial governance and strategic alignment.

Our Services Include:

In today’s complex business environment, effective financial management requires more than just bookkeeping. By embracing the four pillars of financial management—Accounting, Monitoring & Controlling, Budgeting & Forecasting, and Strategy & Communication—businesses can achieve greater financial stability and strategic success.

Found a gap in your financial management? Reach out to Startupmetrics for a comprehensive solution tailored to your needs.