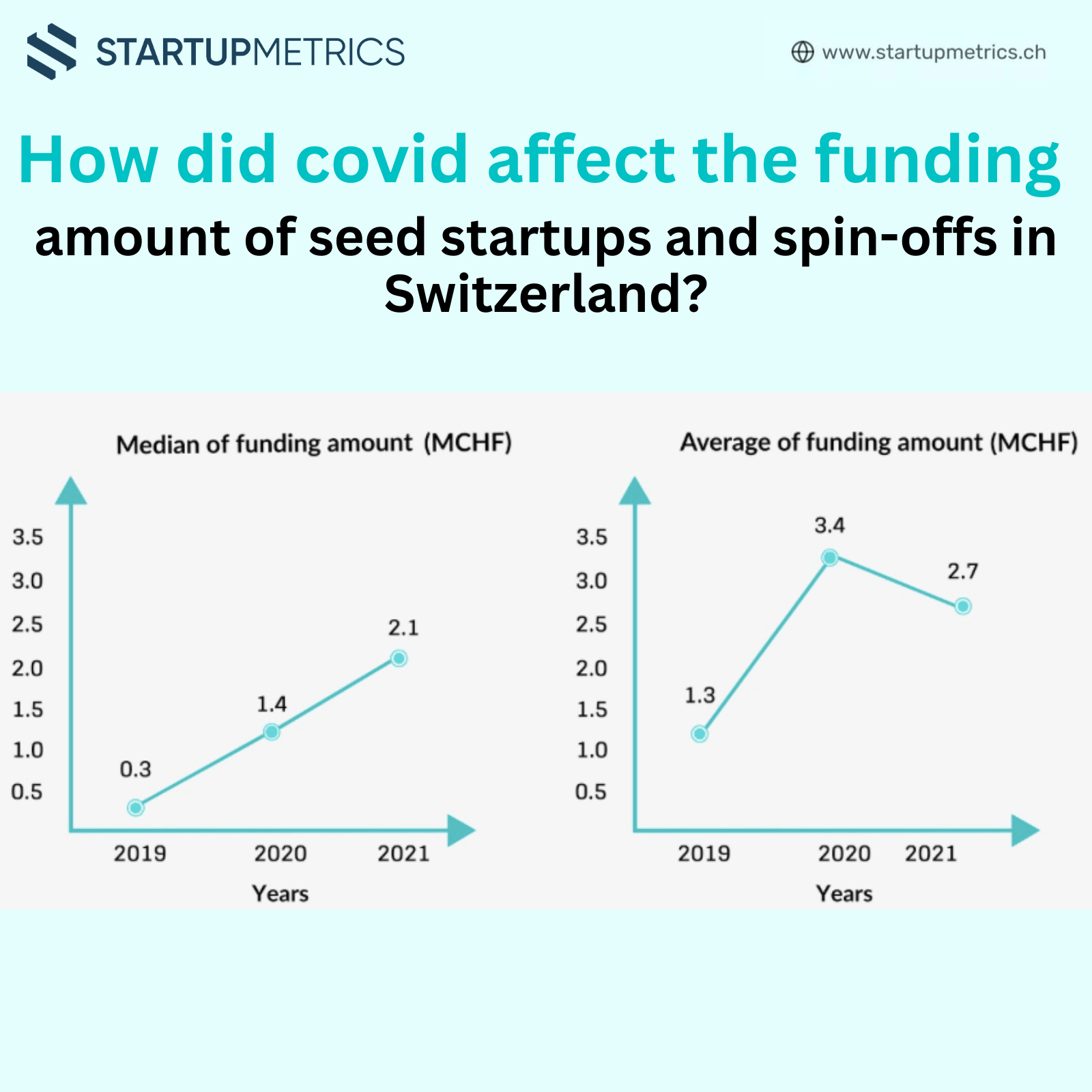

How did covid affect the funding amount of seed startups and spin-offs in Switzerland?

Positive Trends Amidst Challenges Overview Despite the global challenges posed by the COVID-19 pandemic, seed startups and spin-offs in Switzerland…

A prevalent misconception among business owners is that startup strategies and mechanics are too unconventional for established businesses to adopt. However, the financial principles from this field can definitely provide substantial benefits to existing businesses, especially SMEs with an intention to grow.

A prevalent misconception among business owners is that startup strategies and mechanics are too unconventional for established businesses to adopt. However, the financial principles from this field can definitely provide substantial benefits to existing businesses, especially SMEs with an intention to grow.

Adopting startup finance strategies greatly improves SMEs’ insights into their financial health, decision-making capabilities, and ability to identify and resolve issues quickly. Implementing advanced financial analytics tools can provide SMEs with real-time visibility into their financial performance, helping them make informed decisions.

Utilizing startup financial strategies enables SMEs to allocate resources better, prioritize investments in high-return areas, and efficiently manage expenditures with the help of critical sales and financial KPIs. For example, SMEs can use financial modeling to assess the potential ROI of different projects and allocate resources to the most promising opportunities.

SMEs can leverage financial forecasting and business modeling to proactively anticipate market changes, adapt quickly, and strategically focus on key drivers of revenue, profitability, and cash flow. Accurate forecasting helps SMEs prepare for various scenarios and make data-driven decisions to navigate uncertainties.

By developing structured financial plans and showcasing essential metrics like Customer Lifetime Value (CLV), Customer Acquisition Cost (CAC), and profit margins, SMEs can effectively prepare to secure funding or sell their company and engage potential investors professionally. Presenting a clear and compelling financial narrative increases the likelihood of attracting investors and securing favorable terms.

Integrating strategic finance practices aligns financial management with broader business strategies, emphasizes long-term goals, and boosts overall business growth potential. Strategic financial leadership involves setting clear financial goals, developing actionable plans, and continuously monitoring performance to ensure alignment with business objectives.

An example of an SME successfully adopting VC tactics is Shopify. Originally a small business, Shopify embraced VC strategies such as detailed financial modeling and aggressive market penetration. This approach helped Shopify scale rapidly and become a leading e-commerce platform globally. Shopify’s success demonstrates the potential benefits of applying VC tactics to drive growth and achieve market leadership.

By adopting VC tactics, SMEs can gain better financial visibility, improve resource allocation, and enhance investor readiness, ultimately driving sustainable growth and long-term success. Implementing strategies such as lean startup methodology, performance metrics, agile financial management, capital efficiency, and growth hacking can provide SMEs with a competitive edge and support their growth ambitions. Embracing these tactics helps SMEs navigate challenges, seize opportunities, and achieve sustainable growth.