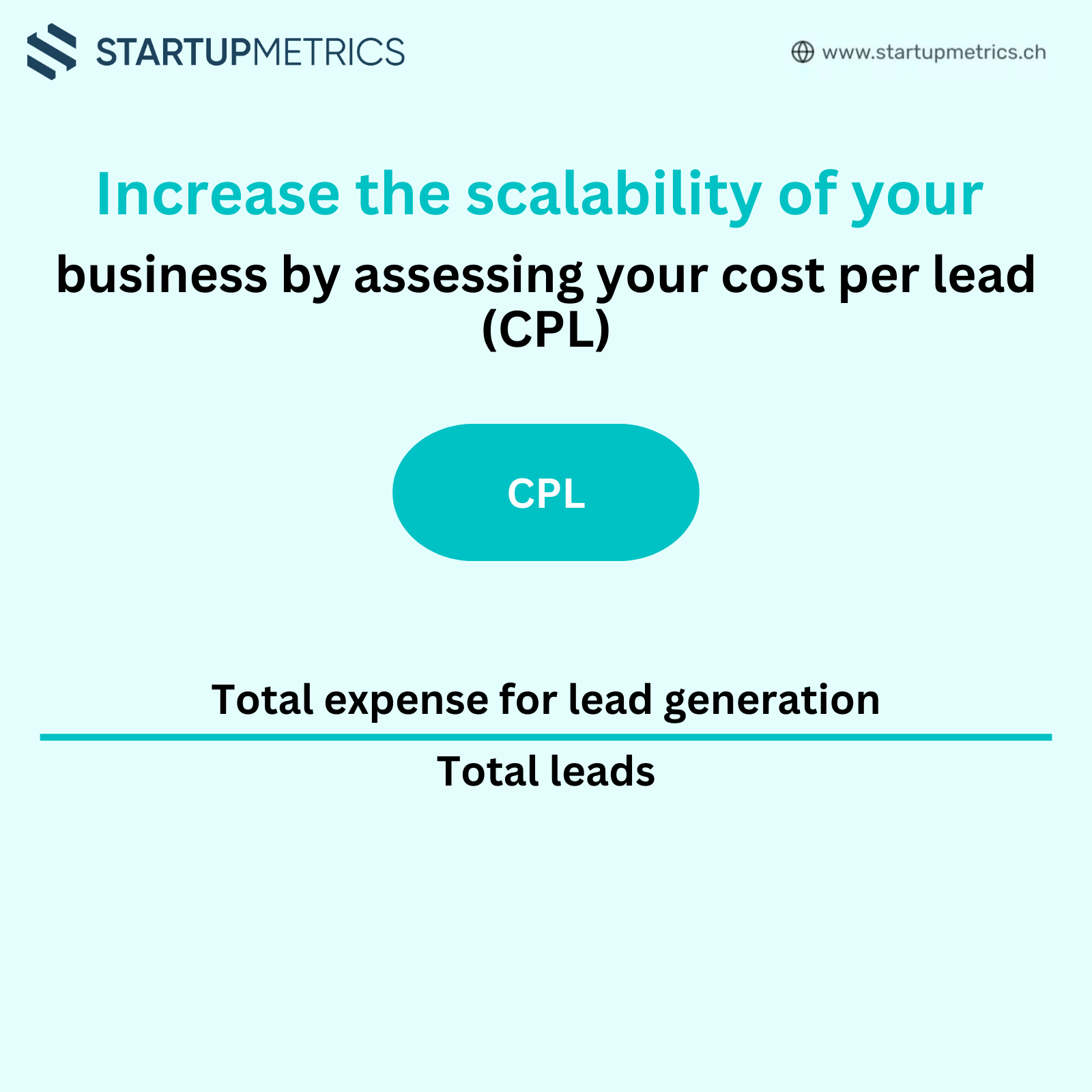

Increase the Scalability of Your Business by Assessing Your Cost Per Lead (CPL)

Since every customer starts as a lead, the number of leads you can generate in a given period and how…

Closing big B2B clients can be a game-changer for your startup, but it’s crucial to ensure your financial metrics are in order before pursuing these opportunities. Here’s a comprehensive guide on how to close large clients and prepare your startup for long-term success.

The first step in closing a big B2B deal is to identify the key decision-maker within the organization. This person is often the CEO, CFO, or a senior executive with the authority to approve the contract. Qualify your leads to ensure you’re targeting the right person, and have a clear understanding of their needs and pain points.

When presenting your solution to a potential big client, focus on how it will address their specific challenges and provide tangible benefits. Highlight the unique value proposition of your product or service and how it aligns with their objectives. Use case studies or testimonials from existing clients to build credibility and trust.

Be prepared to address any concerns or objections from the prospect. Listen carefully to their questions and provide thoughtful, prompt answers. If necessary, be willing to negotiate certain aspects of the deal, such as pricing or contract terms. However, ensure that any concessions you make still allow you to maintain profitability.

Employ effective sales closing techniques to increase your chances of success. Some popular methods include:

Before pursuing big B2B clients, it’s crucial to ensure your startup’s financial metrics are prepared for growth. Key metrics to track include:

These metrics help predict your revenue and understand your growth potential. Keeping these metrics in check allows you to project the scalability of your business.

LTV represents the expected revenue from a customer over their lifetime. It helps you determine whether your product-market fit is strong enough to warrant the investment from a large B2B client.

CAC measures the cost of acquiring a new customer. Ensure your CAC is lower than your LTV to maintain profitability when onboarding large clients.

Your gross margin reflects the revenue retained after subtracting the cost of goods sold. A higher gross margin means you have more room for profitability when dealing with larger clients.

Runway represents the number of months your startup can operate before running out of cash. It’s crucial to have a healthy runway to support the growth and demands of big B2B clients.

Closing big B2B clients can transform your startup, but it’s essential to approach these opportunities strategically. Identify the decision-maker, emphasize the benefits, address concerns, utilize proven closing techniques, and ensure your financial metrics are in order. By following these steps, you’ll increase your chances of success and position your startup for sustained growth.