Funding type statistics of ETH & EPFL Spin-offs founded between 2017-2020

17.02.2023

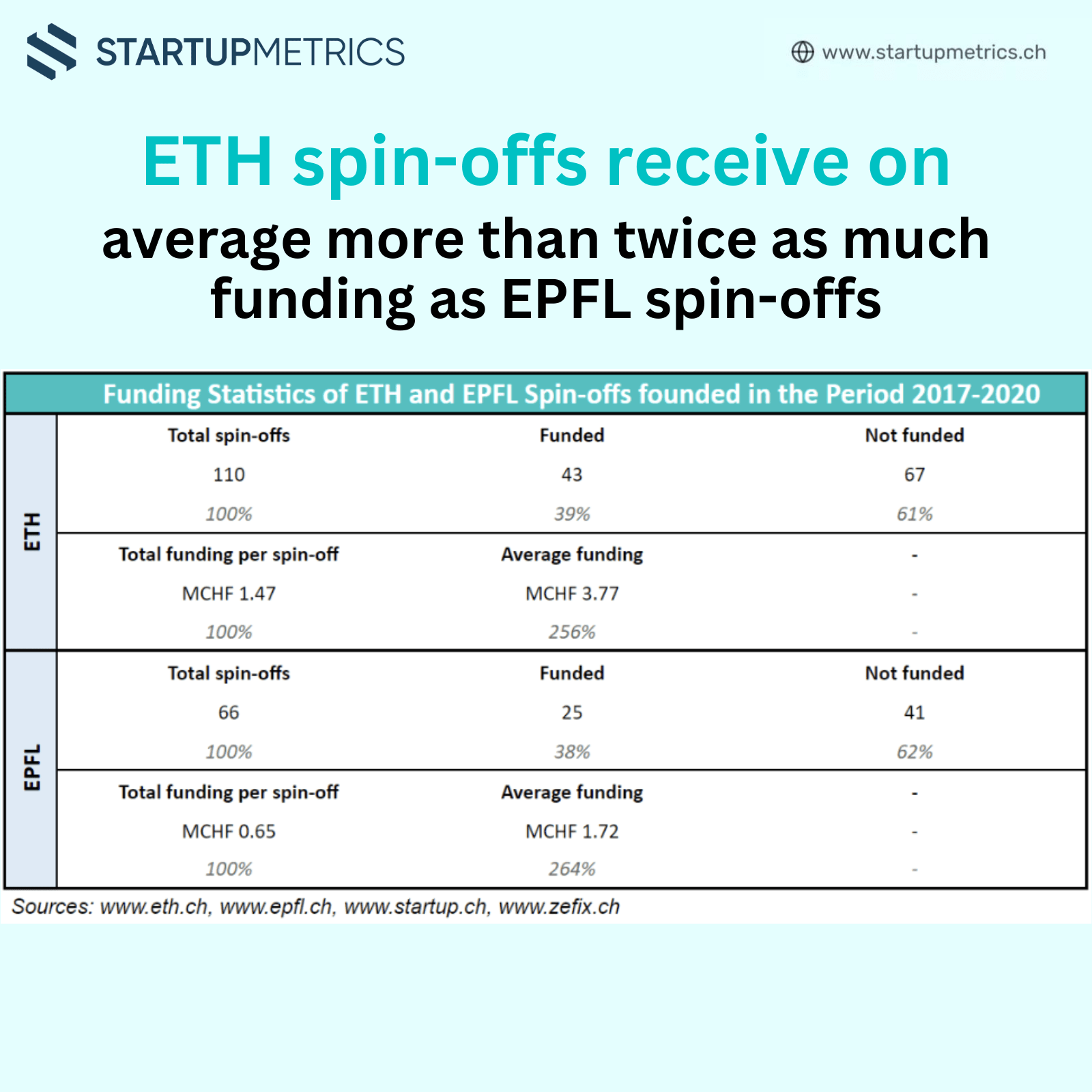

Well-funded startups grow faster compared to bootstrapped ones. What type of funding did the ETH and EPFL spin-offs launched between 2017 and 2020 receive so far? What can you do to increase your probability of being well-funded?

Funding Overview

Seed Rounds

- ETH Spin-offs: 41% raised a seed round with an average funding amount of CHF 1.5 million.

- EPFL Spin-offs: 44% raised a seed round with an average funding amount of CHF 0.6 million.

Series A Rounds

- ETH Spin-offs: 12% received Series A funding, averaging CHF 6.2 million.

- EPFL Spin-offs: 11% received Series A funding, averaging CHF 3.4 million.

Grants

- ETH Spin-offs: Higher likelihood of receiving grants compared to EPFL spin-offs.

- EPFL Spin-offs: Although fewer grants were received, the average amount for grants tends to be higher, particularly in the French-speaking part.

Strategies to Increase Your Probability of Being Well-Funded

Seed Phase

- Target a Large Market: Ensure that your spin-off addresses a market substantial enough to attract investor interest.

- Develop Disruptive Technology: Create technology that disrupts existing solutions and is difficult for competitors to replicate.

- Build a Strong Core Team: Assemble a team with the necessary skills and experience, and establish a robust network within your field.

- Run Pilot Projects: Conduct initial pilot projects with potential customers to validate your technology and demonstrate its market potential.

Beyond the Seed Stage

Focus on finding product-market fit. Investors will commit larger sums to your company once they are convinced of your ability to scale with reasonable unit economics.

Case Study: ETH vs. EPFL Spin-offs

Funding Amounts

- ETH Spin-offs: The higher average funding amounts in both seed and Series A rounds suggest a greater confidence from investors in these spin-offs, possibly due to their robust market strategies and disruptive technologies.

- EPFL Spin-offs: Despite receiving lower average funding amounts, the consistency in receiving seed rounds indicates a solid foundation that can be built upon by enhancing product-market fit and demonstrating scalability.

Regional Differences

- German-speaking Part: Spin-offs here received significantly higher funding amounts, indicating a more vibrant venture capital scene and possibly better access to professional support.

- French-speaking Part: Higher average grant amounts suggest a strong support system for early-stage funding, but the lower overall funding highlights the need for better integration with larger venture capital networks.

Key Takeaways for Spin-offs

Focus Areas for Seed Phase

- Market Size: Clearly demonstrate the potential market size to investors.

- Technology Disruption: Highlight how your technology is unique and difficult to replicate.

- Team Strength: Showcase the expertise and cohesiveness of your team.

- Customer Validation: Present data from pilot projects that validate your product’s market fit.

Moving to Series A and Beyond

- Product-Market Fit: Continuously refine your product to ensure it meets market demands effectively.

- Scalability: Develop and present a clear plan showing how your business can scale efficiently with reasonable unit economics.

Conclusion

By understanding the funding landscape and adopting strategies that align with investor expectations, both ETH and EPFL spin-offs can enhance their attractiveness to potential investors. Focusing on market size, technology disruption, team strength, and customer validation during the seed phase, and ensuring product-market fit and scalability beyond that, are critical steps towards securing substantial funding and achieving sustainable growth.

Find the article on find product market fit