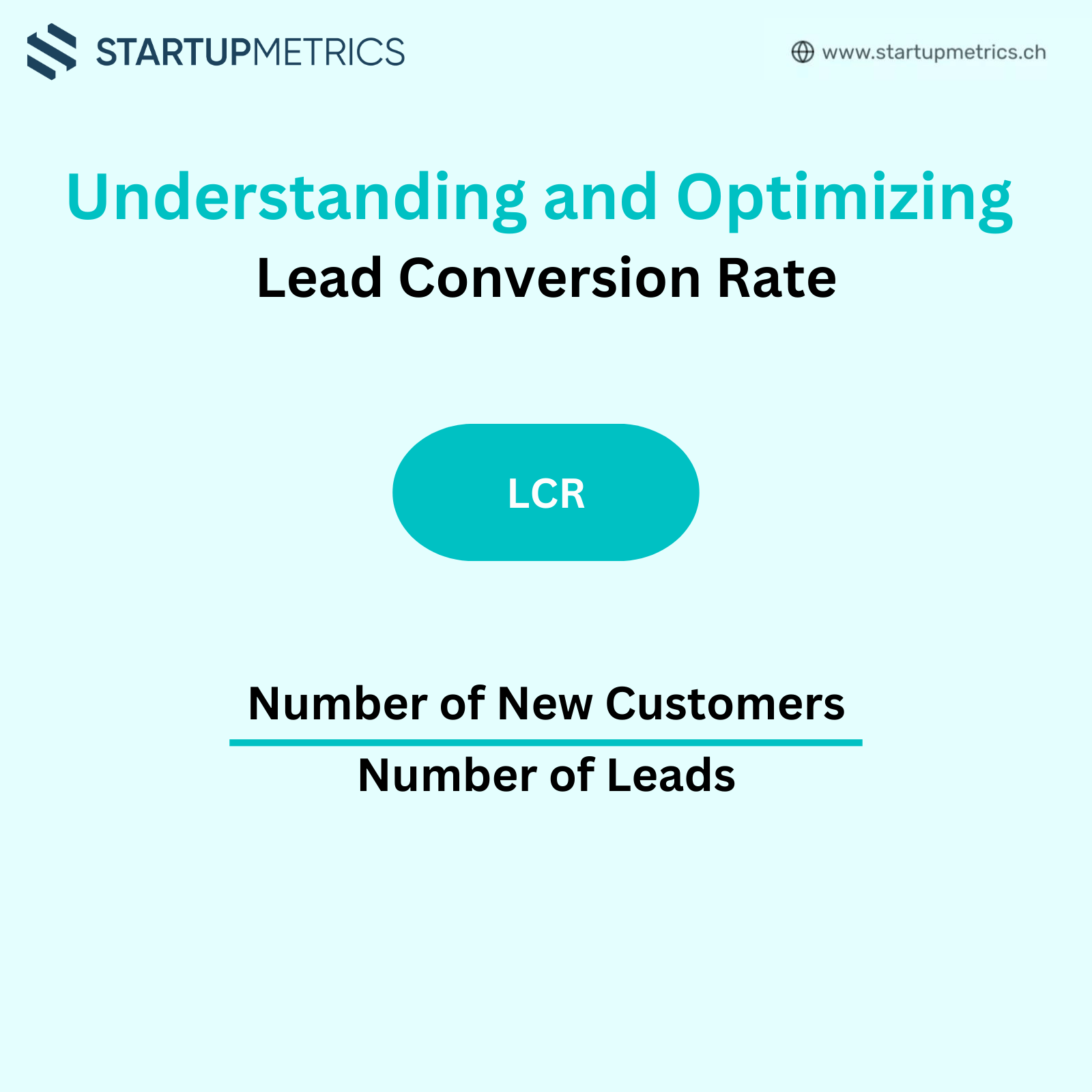

Understanding and Optimizing Lead Conversion Rate

The lead conversion rate is a valuable metric that tells you how many potential customers you need to connect with…

Valuing pre-revenue start-ups, especially those spun off from top universities, involves analysing a specific data set with comparable transactions. Differences in qualitative factors such as team strength, technology innovation, and market potential justify deviations from the mean valuation. In this post, we discuss the average and median pre-money valuation of early-stage spin-offs from two of Switzerland’s leading universities: ETH Zurich (ETH) and École Polytechnique Fédérale de Lausanne (EPFL).

The pre-money valuation of ETH spin-offs in the seed stage is significantly higher than that of EPFL spin-offs. Specifically, ETH spin-offs have a valuation that is likely to be 78% to 146% higher than EPFL spin-offs. This higher valuation can be attributed to factors such as the stronger perceived brand and market potential of ETH-based startups. Additionally, the distribution is skewed to the right, indicating that most spin-offs are valued below the average, but a few high-valued startups pull the average up.

The Series A pre-money valuations also show significant differences. On average, ETH spin-offs have a pre-money valuation that is 116% higher than EPFL spin-offs. However, the median valuations of the two groups are comparable, with only a slight deviation of 3.39%. This suggests that while the top ETH spin-offs achieve higher valuations, the overall distribution of valuations between the two universities is more aligned at this stage.

The valuation of spin-offs from ETH and EPFL during the seed and Series A phases reveals a significant difference in average valuations, with ETH spin-offs generally receiving higher pre-money valuations. However, the median valuations at the Series A stage are quite similar, indicating that both institutions produce high-quality startups capable of achieving substantial valuations as they progress.

Understanding these valuation trends can help prospective investors make informed decisions and assist founders in setting realistic expectations during their fundraising efforts.