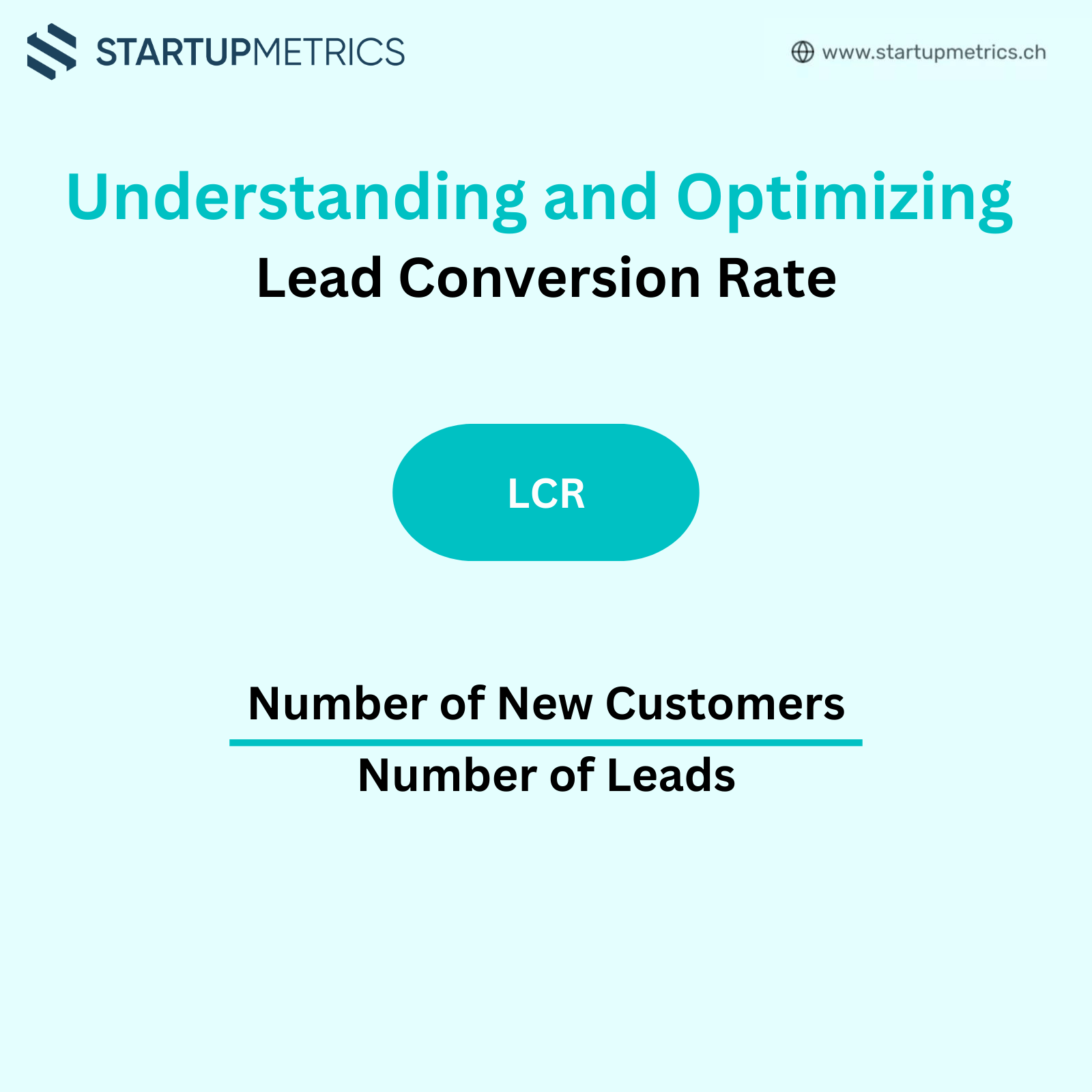

Understanding and Optimizing Lead Conversion Rate

The lead conversion rate is a valuable metric that tells you how many potential customers you need to connect with…

Not long ago, a growing startup on the verge of securing seed funding contacted us. You may wonder why they sought assistance when funding seemed nearly secured. The investment journey was turbulent. Strong investors, recognizing the company’s potential, offered substantial investment but with very high demands – the founders nearly gave away half of their company.

In this blog post, we’ll delve into the common challenges faced during seed funding, the collaborative strategies that helped this startup succeed, and key strategies for navigating investor pressure effectively.

One significant challenge was the late communication of investment terms. The terms and company value surfaced very late in discussions, leaving little room for negotiation. This lack of transparency and timing put the founders in a difficult position, forcing them to make decisions under pressure. The delayed revelation of terms often leads to rushed decisions, which can be detrimental to a startup’s future.

The initial discussions with investors were time-consuming, limiting the availability to engage multiple investor options. The extended negotiation period also caused delays in securing funding, which affected the company’s growth plans. Lengthy negotiations can be a double-edged sword; while thorough discussions are essential, they can also stall progress and hinder a startup’s ability to capitalize on market opportunities.

A convergence of interested investors unified to exercise substantial influence, leaving the founders feeling cornered. This collective bargaining power of the investors reduced the founders’ ability to negotiate favorable terms. When investors form a united front, it can significantly tilt the balance of power, making it challenging for founders to advocate for their interests effectively.

To address these challenges, we delivered a robust investment proposal embodying clarity and precision. This included detailed financial projections, business plans, and market analysis. The comprehensive proposal helped in clearly communicating the company’s value and growth potential to investors. A well-structured proposal is crucial in establishing credibility and showcasing the startup’s preparedness and potential for success.

Leveraging our extensive experience with investors, we facilitated and streamlined communication, ensuring transparency and mutual understanding. This involved organizing structured meetings and providing clear documentation to address all investor concerns. Regular updates and open communication channels helped build trust and foster positive relationships with investors. Transparent communication is key to managing expectations and building investor confidence.

The improved documentation supported the founders in attracting more potential investors, creating a competitive environment that benefited the company. By presenting a well-prepared and transparent investment proposal, the company was able to generate interest from multiple investors, increasing their bargaining power. A competitive investment environment can lead to more favorable terms and conditions for the startup.

The result was a revived negotiation, strengthening the company’s position. The improved financial strategy we communicated with our client doubled the company’s valuation and enabled the founders to retain a more substantial stake, only giving away 20% instead of 50%. This outcome not only preserved the founders’ equity but also provided the necessary funding to support the company’s growth plans. Effective negotiation and strategic planning can significantly enhance a startup’s valuation and equity retention.

Start preparing for negotiations well before seeking funding. Develop detailed financial models, business plans, and market analyses to present a compelling case to investors. This preparation ensures that you are ready to answer any questions and provide detailed information to potential investors. Early preparation allows for a more confident and informed negotiation process.

Maintain open and clear communication with potential investors. This includes being transparent about your company’s valuation, financial health, and growth prospects from the start. Clear communication helps build trust and ensures that investors have a realistic understanding of the company’s potential. Transparency is crucial in establishing a strong foundation for investor relations.

Engage with multiple investors to avoid being cornered by a single influential group. A diversified investor pool increases competition and improves your negotiating position. By seeking investment from various sources, you can find investors who align with your company’s vision and values. Diversification in investor relations can lead to more balanced and favorable terms.

Engage professional advisors, such as financial consultants and legal experts, to assist in negotiations. Their expertise can help you navigate complex terms and conditions. Professional advisors can provide valuable insights and help you make informed decisions during the negotiation process. Expert advice is invaluable in securing favorable investment terms.

Understand what drives your investors. Some may prioritize high returns, while others might value a strategic partnership. Align your pitch to their motivations. By understanding the investors’ goals and interests, you can tailor your proposal to meet their expectations and secure favorable terms. Knowing investor motivations can help in crafting a more compelling and targeted pitch.

Slack, the popular business communication platform, provides a great example of navigating investor pressure effectively. During its seed funding stage, Slack’s founders ensured clear communication of their vision and financial health. They engaged with multiple investors, which helped them secure favorable terms and retain significant control over their company. Slack’s strategic approach to investor relations contributed to its successful funding rounds and eventual IPO. Slack’s success story highlights the importance of strategic planning and effective communication in securing favorable investment terms.

Telling a compelling business story is a solid cornerstone that founders should bring to the table, but to truly excel in investor negotiations, one must master the numerical game and communicate adeptly in the investors’ lingo. By preparing thoroughly, maintaining clear communication, and leveraging professional advice, startups can navigate the pressures of seed funding effectively and secure favorable terms that support their long-term growth. Successful negotiation requires a combination of strategic planning, clear communication, and understanding investor motivations. With these strategies, founders can confidently navigate the challenges of securing seed funding and build a strong foundation for their company’s future growth.